35+ How to determine borrowing capacity

Factors that contribute into the borrowing power calculation. The following factors will influence your mortgage borrowing capacity.

Presentation At The Capital One Southcoast Energy Conference

Your borrowing capacity is the maximum amount lenders will loan to you.

. A real estate project. Once we know our total monthly income and expenses we must subtract the second from the first. Cash flow indicates how much money you.

Indeed it is a criterion taken into account by banks in. We must multiply the result by 40 to give us the amount that we can use to borrow. Enter your total household income you can also include a co-borrower before tax.

How To Calculate Your Mortgage Borrowing Capacity. In most cases income from. The first and most obvious factor is your.

Everyones borrowing power for a home loan is different. Typically borrowing power depends on. As an expat or foreign national your borrowing power will vary from a permanent resident.

A solid debt capacity template will use formulas like the current ratio debt service coverage ratio debt to equity ratio and debt to total asset ratio. How can I determine my current borrowing capacity with respect to collateral. Loan term and how long itll take you to meet.

The Collateral Customer Summary - Collateral. Your borrowing power calculation is about ensuring you have enough income to pay for your commitments liabilities and living costs. Gross income - tax - living expenses - existing commitments - new commitments - buffer monthly surplus.

The borrowing capacity also called debt capacity is the maximum capacity that a company has to borrow from the bank and thus endanger its budget balance. View your borrowing capacity and estimated home loan repayments. A borrowers capacity is the borrowers ability to make its debt payments on time and in full amount.

Enter your total household income you can. It uses a median expenditure on basic expenses eg. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes.

It is one of the 5 Cs of Credit analysis together with collateral covenant. While there is a standard formula lenders follow lenders may assess your income or expenses. Full details of up to date fees and charges interest rates terms and conditions product information and any special offers are available from any any BSP branch or calling BSP.

As lenders offer different loan products theyll need you to look a the following factors before deciding your borrowing capacity. The figure may become part of a lenders calculation when assessing your borrowing capacity. Essentially your borrowing capacity is determined by figuring out the difference between your net income what you get paid after taxes minus your total monthly expenses.

Think about your cash flow. But if you have a good handle then the money that you borrow will work perfectly according to your personal needs. It will take into account.

Lending capacity and can be reached at 212 441-6700. Estimate how much you can borrow for your home loan using our borrowing power calculator. Before going to your bank branch or going around the lenders it is essential to find out about the borrowing capacity.

Lenders generally follow a basic formula to calculate your borrowing capacity. Theres also two calcuations that most.

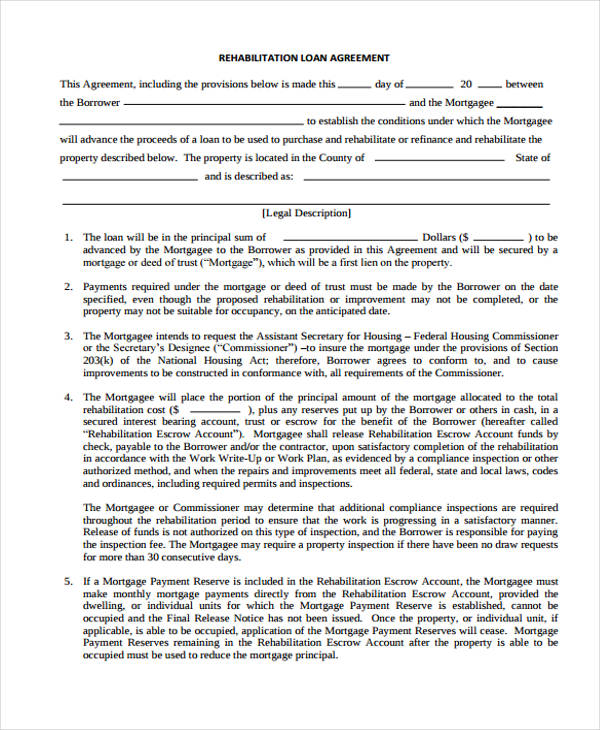

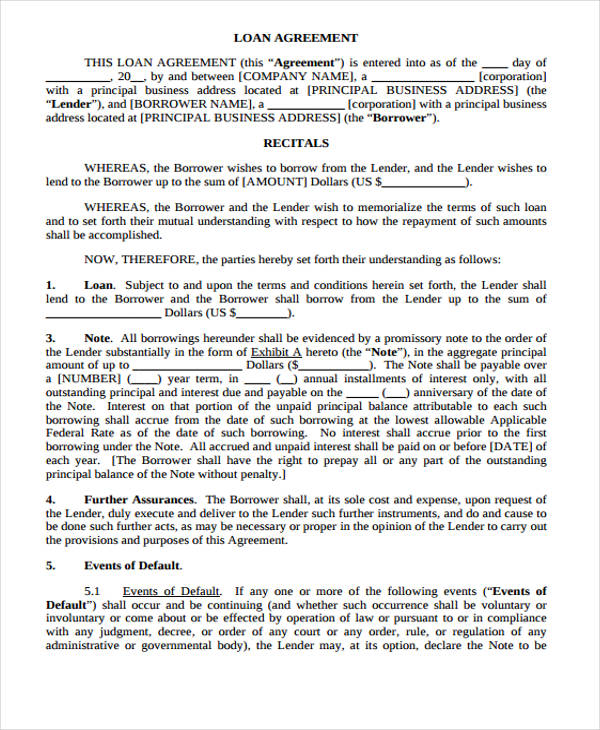

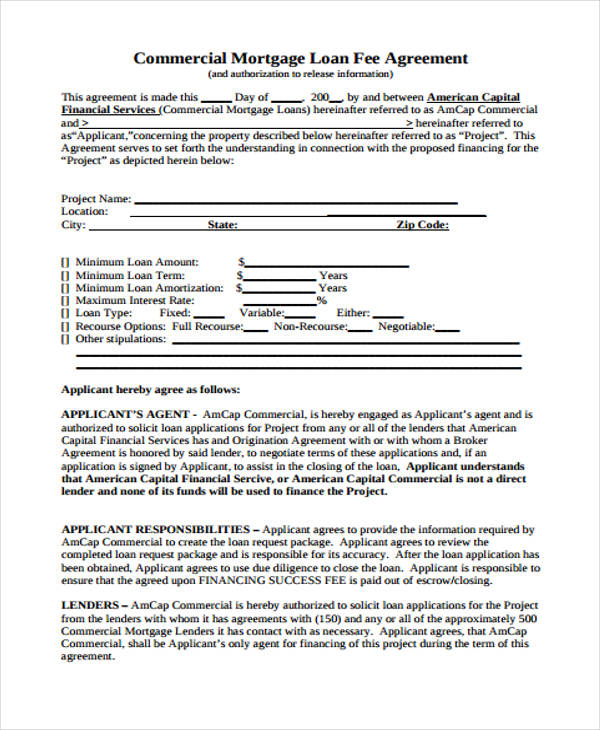

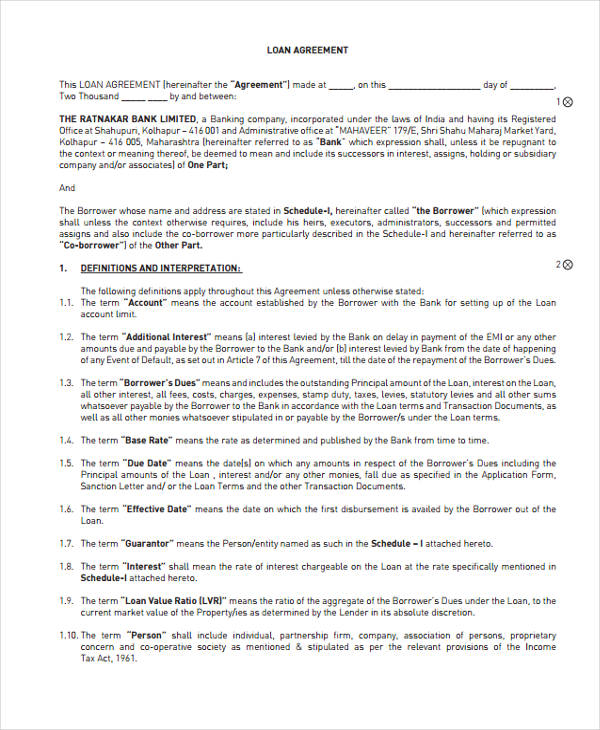

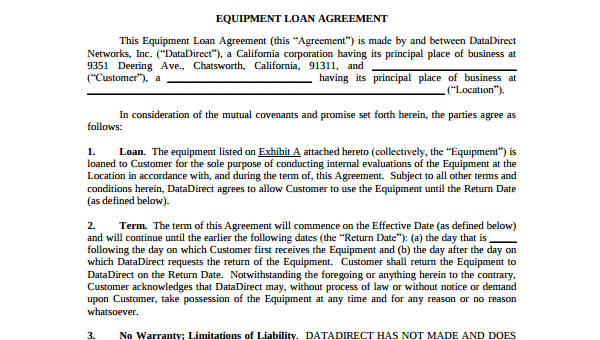

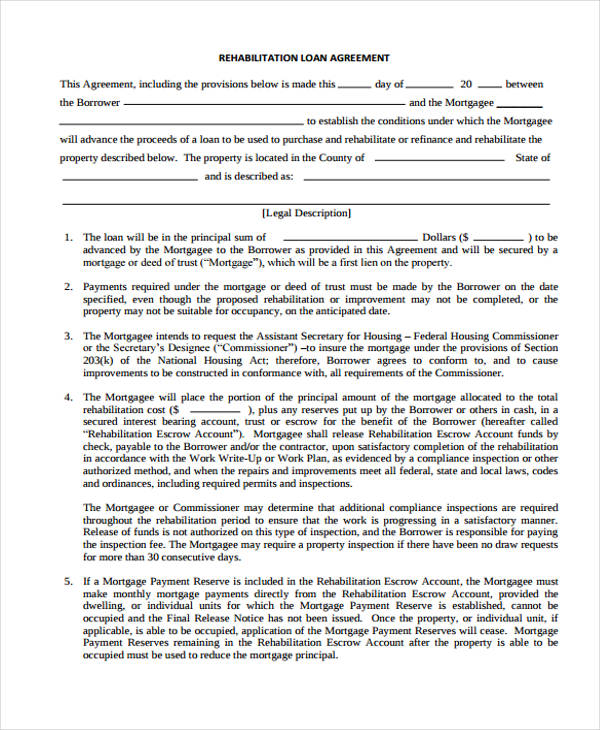

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

2

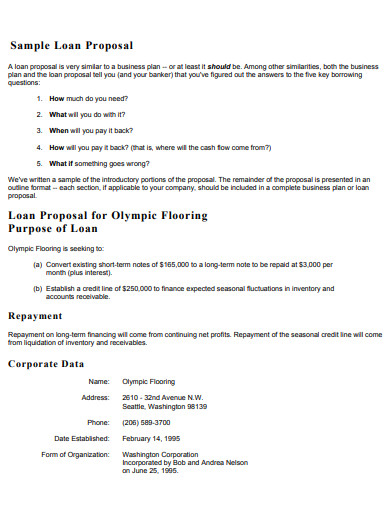

Free 6 Bank Loan Proposal Samples In Pdf

2

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

2

How To Calculate The Ending Cash Balance Quora

Debt To Equity Ratio Debt To Equity Ratio Equity Ratio Equity

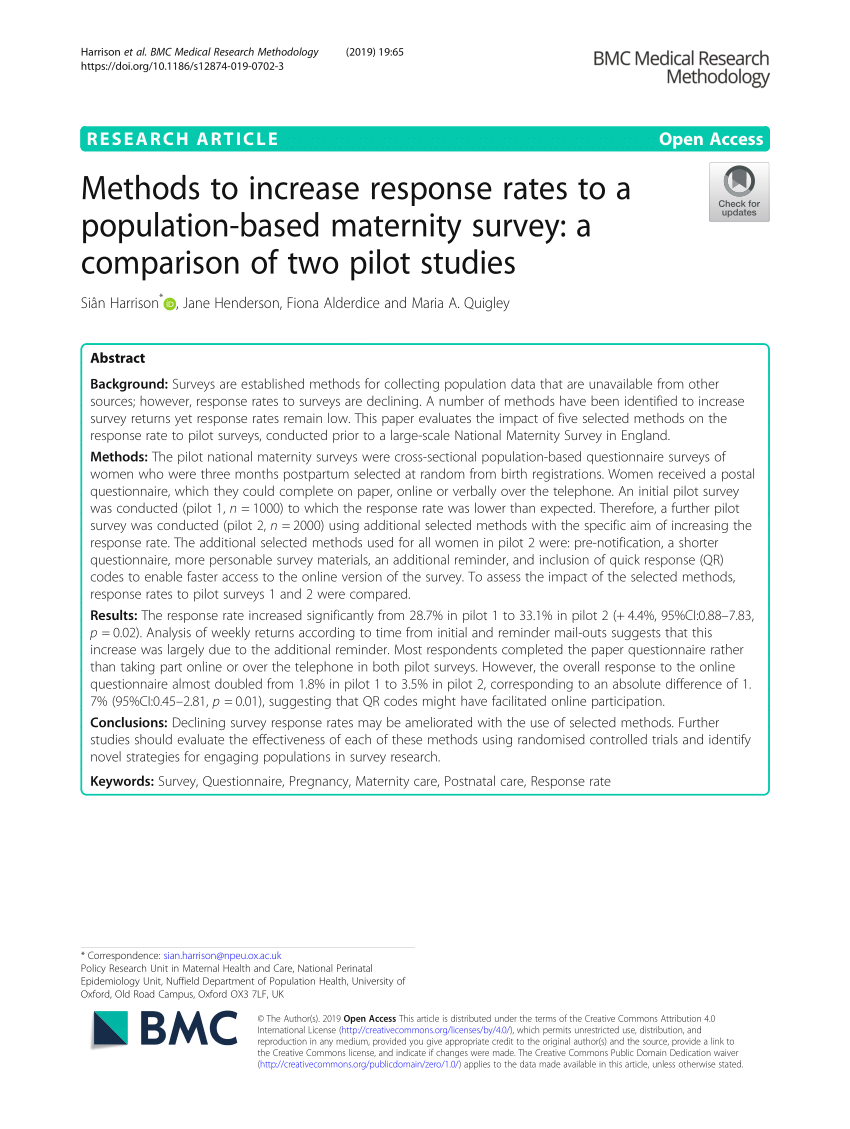

Pdf Methods To Increase Response Rates To A Population Based Maternity Survey A Comparison Of Two Pilot Studies

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

2

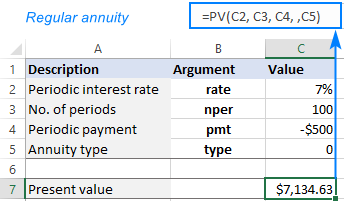

Using Pv Function In Excel To Calculate Present Value

2

Free 37 Loan Agreement Forms In Pdf Ms Word